Knowledge Base

Learning and Documentation

Lets gets started!!

- Version: 1.0

- Author: Learning and Documentation

- Created: 3 February, 2023

- Update: 3 February, 2023

If you have any questions that are beyond the scope of this help file, Please feel free to email via Item Support Page.

Knowledge - Till date

Structure

If you need more information, please visit bootstrap site: https://getbootstrap.com

Reports

Trends

Business Trends

The Company

The Client

Knowledge Base -2023

Learning and Documentation -2023

Lets gets started!! - 2023

- Version: 1.0

- Author: Learning and Documentation - 2023

- Created: 3 February, 2023

- Update: 3 February, 2023

If you have any questions that are beyond the scope of this help file, Please feel free to email via Item Support Page - 2023 .

Knowledge - 2023

Structure 2023

If you need more information, please visit bootstrap site: https://getbootstrap.com

Reports 2023

Trends 2023

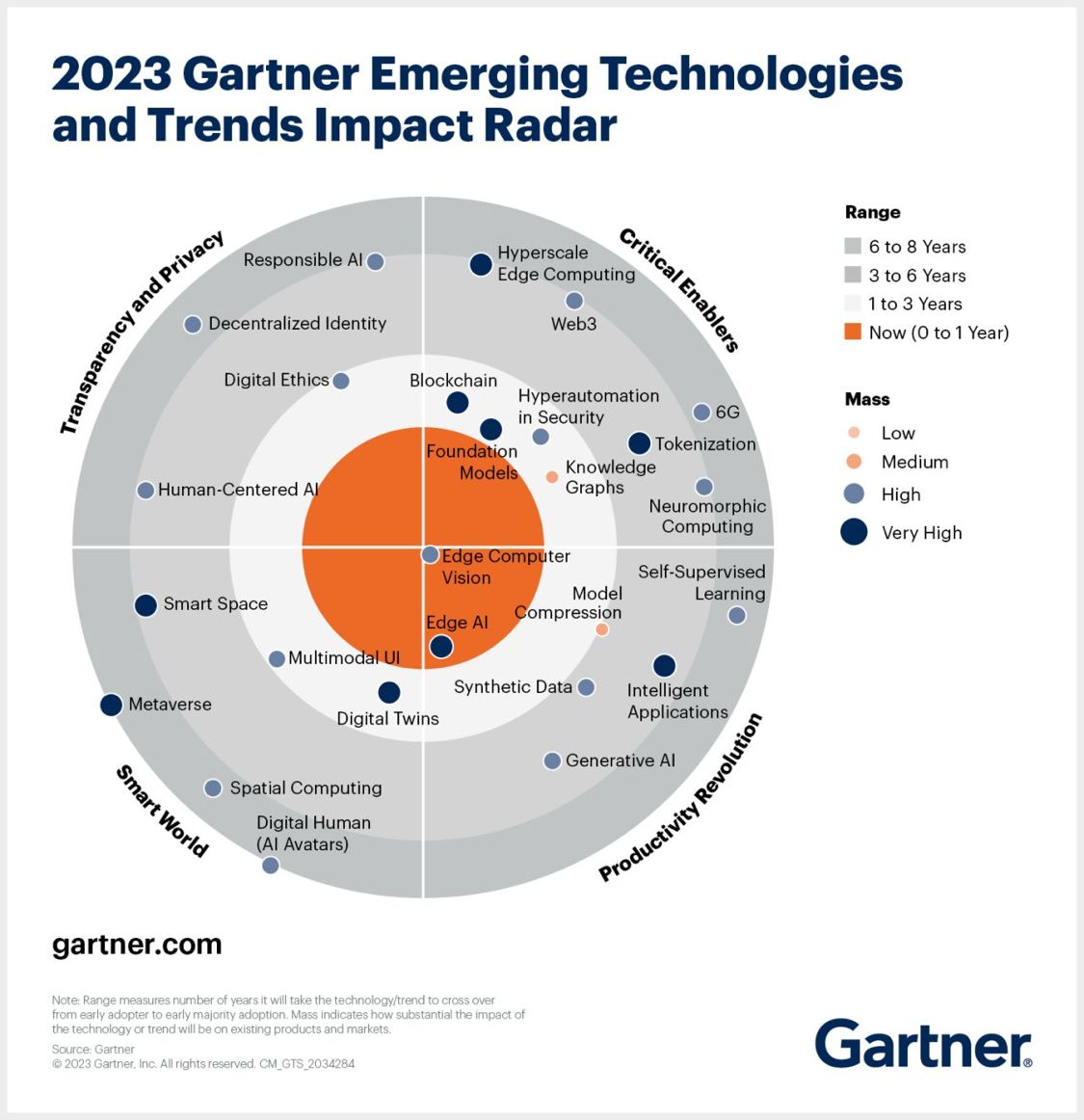

Categories

-

Productivity Revolution

-

Critical Enablers

-

Transparency and Privacy

-

Smart World

Productivity Revolution 2023

0-1 YearEdge computer vision refers to the use of computer vision technologies and algorithms on devices located at the edge of a network, rather than in the cloud or a data center. This allows for real-time image and video processing and analysis closer to the source of data, reducing latency and enabling faster decision-making in applications such as security, surveillance, industrial automation, and autonomous vehicles.

Edge computer vision can be used in a variety of applications, including:- Industrial automation: for tasks such as quality control and inspection, object recognition and tracking.

- Surveillance and security: for real-time face and object recognition, monitoring and analysis of footage.

- Autonomous vehicles: for tasks such as object detection, lane detection, and traffic sign recognition.

- Healthcare: for medical imaging analysis, such as X-rays and MRIs.

- Retail: for tasks such as product identification and tracking, customer behavior analysis.

- Agriculture: for tasks such as plant and crop monitoring, and soil analysis.

- Robotics: for tasks such as object detection, navigation and manipulation.

Edge computer vision can be used in the property and casualty insurance industry in various ways, including:

- Claims processing: for tasks such as damage assessment, estimating repair costs, and fraud detection.

- Surveys and inspections: for tasks such as building inspection, roof and exterior analysis, and identifying potential hazards.

- Underwriting: for tasks such as property evaluation, risk assessment and property classification.

- Customer service: for tasks such as real-time damage assessment and providing a virtual tour of the property.

- Fraud detection: for tasks such as identifying fake or altered images, detecting false or misleading information in insurance claims.

By using edge computer vision technologies, insurance companies can improve their operational efficiency, speed up claims processing and reduce costs, as well as enhance the customer experience.

Edge AI refers to the deployment of artificial intelligence algorithms and models at the edge of a network, close to the source of data, rather than in a centralized data center or the cloud. Edge AI allows for real-time processing and decision making without relying on the cloud, reducing latency, and increasing privacy and security.

Edge AI can be used in a variety of industries and applications, including:- Industrial automation: for predictive maintenance, quality control and inspection, and process optimization.

- Healthcare: for medical imaging analysis, patient monitoring, and drug discovery.

- Retail: for tasks such as customer behavior analysis, inventory management, and product identification.

- Transportation: for tasks such as autonomous vehicles, traffic management and vehicle safety.

- Agriculture: for tasks such as precision farming, crop monitoring, and soil analysis.

- Security and surveillance: for tasks such as real-time face recognition, object detection, and monitoring.

Edge AI can be used in the property and casualty insurance industry in several ways, including:

- Claims processing: for tasks such as damage assessment, estimating repair costs, and fraud detection.

- Surveys and inspections: for tasks such as building inspection, roof and exterior analysis, and identifying potential hazards.

- Underwriting: for tasks such as property evaluation, risk assessment, and property classification.

- Customer service: for tasks such as real-time damage assessment and providing a virtual tour of the property.

- Fraud detection: for tasks such as identifying fake or altered images, detecting false or misleading information in insurance claims.

By using edge AI technologies, insurance companies can improve their operational efficiency, speed up claims processing, reduce costs, and enhance the customer experience. For example, edge AI algorithms can process images and videos captured by drones or other devices to perform real-time damage assessment and reduce the need for manual inspection. Additionally, edge AI can be used to analyze data from various sources to identify patterns and detect fraud, improving the accuracy and speed of the claims process.

Model compression is the process of reducing the size and complexity of a machine learning model without significantly affecting its performance. This can be done through techniques such as pruning, quantization, and low-rank factorization.

There are several use cases for model compression, including:- Deploying models on edge devices with limited computational resources

- Reducing the latency of online inference

- Improving the speed and efficiency of training

- Reducing the cost of storing and transmitting large models

In the context of property and casualty insurance, model compression can be used to improve the efficiency of predictive models that are used to assess risk. For example, a predictive model that is trained to identify potential fraud could be compressed to make it faster and more efficient to run in real-time. Additionally, a model that is used to assess the risk of a property could be compressed to reduce the storage and computational requirements, allowing for it to be used on a large scale.

Overall, model compression can play an important role in the property and casualty insurance industry by enabling more efficient and accurate risk assessments, which can ultimately improve the overall efficiency and profitability of the industry.

Synthetic data refers to artificial data generated by computer algorithms, as opposed to real-world data that is collected from sources such as sensors or surveys. Synthetic data can be used to simulate real-world scenarios and can be useful for training machine learning models, testing algorithms, and validating systems.

Some use cases for synthetic data include:- Data augmentation: Creating additional data to supplement real-world data when there is limited availability.

- Privacy protection: Generating data that resembles real-world data but without the sensitive information, allowing organizations to share data for research or testing purposes without exposing private information.

- Model validation: Generating data to test machine learning models and validate their accuracy and reliability.

In the context of property and casualty insurance, synthetic data can be used in various ways, including:

- Risk assessment: Generating data that can be used to simulate different scenarios and assess the risk of potential losses.

- Policy pricing: Generating data that can be used to train machine learning models to estimate the cost of insuring a property or asset.

- Fraud detection: Generating synthetic data that can be used to train machine learning models to detect fraud in claims processing.

In general, synthetic data can help property and casualty insurance companies improve their underwriting and risk management processes by providing them with additional data to analyze and make informed decisions. Additionally, synthetic data can help protect sensitive information and enable companies to share data for research and testing purposes without exposing private information.

The main difference between synthetic data and real-world data is that synthetic data is generated, while real-world data is collected. Synthetic data is created using algorithms that can simulate real-world scenarios and produce data that is similar in structure and content to real-world data. This makes synthetic data useful for a variety of purposes, including training machine learning models, testing algorithms, and validating systems.

In contrast, real-world data is collected from actual sources and reflects real-world events, behaviors, and measurements. This makes real-world data more representative of actual conditions, but it can also contain biases, errors, and missing information.

Another difference between synthetic data and real-world data is that synthetic data can be generated in quantities that are not possible with real-world data. For example, it is possible to generate millions of synthetic data points in a short amount of time, which can be useful for training machine learning models.

In conclusion, synthetic data and real-world data are both useful in their own ways, and they can be used together to improve the accuracy and reliability of machine learning models and other data-driven systems. Synthetic data is useful when there is limited real-world data available, when real-world data contains sensitive information, and when large quantities of data are needed for training or testing purposes. Real-world data is useful when it is important to have accurate and representative data for real-world scenarios.

Generative AI refers to artificial intelligence systems that can generate new data, such as images, text, or sound, based on examples or patterns provided during training.

Some use cases for generative AI include:- Image generation: Creating new images of objects, people, or scenes that look similar to real images.

- Text generation: Creating new text based on existing text data, such as product descriptions, news articles, or customer reviews.

- Audio generation: Generating new audio files that sound similar to existing audio files.

In the context of property and casualty insurance, generative AI can be used in various ways, including:

- Fraud detection: Generating fake images or texts that can be used to train machine learning models to detect fraud in claims processing.

- Risk assessment: Generating synthetic data that can be used to simulate different scenarios and assess the risk of potential losses.

- Policy pricing: Generating data that can be used to train machine learning models to estimate the cost of insuring a property or asset.

In general, generative AI can help property and casualty insurance companies improve their underwriting and risk management processes by providing them with more data to analyze and make informed decisions.

6-8 Year

TOTAL : 7

Critical Enablers 2023

1-3 Year3-6 Year

6-8 Year

TOTAL : 9

Transparency & Privacy 2023

1-3 Year3-6 Year

6-8 Year

TOTAL : 4

Smart World 2023

1-3 Year3-6 Year

6-8 Year

TOTAL : 6

Business Trends 2023

- Digital Transformation: P&C insurers are investing in digital technologies to modernize their operations, improve customer experiences, and streamline processes.

- Customer-focused innovation: P&C insurers are exploring new products and services that are tailored to meet the specific needs of their customers.

- Data and Analytics: P&C insurers are leveraging big data and analytics to improve their underwriting and claims processes, as well as to better understand customer behavior and preferences.

- Telematics and IoT: P&C insurers are incorporating telematics and the Internet of Things (IoT) into their offerings to provide more personalized and targeted insurance solutions.

- Cybersecurity: P&C insurers are prioritizing cybersecurity measures to protect their customers' personal information and prevent data breaches.

- Sustainability: P&C insurers are focusing on sustainability and environmental responsibility, offering eco-friendly insurance products and investing in sustainable business practices.

- Distribution channels: P&C insurers are exploring new distribution channels, including insurtech startups and online marketplaces, to reach customers in new and innovative ways.

- Mergers and Acquisitions: P&C insurers are consolidating to increase market share and improve operational efficiency, as well as to acquire new capabilities and technologies.

- Data driven Workflow and process automation: P&C insurers are incorporating data driven automation (one of the data points would be data collected via telematics) using various models.

- A Digital Adoption Platform: P&C insurers are enabling a platform that is used to make the enterprise software adoption process seamless.

The Company 2023

The Client 2023

FAQ

A FAQ is a list of frequently asked questions (FAQs) and answers on a particular topic.

Source & Credits

Support

We are located in GMT +5:30 time zone and we answer all questions within 12-24 hours in weekdays. In some rare cases the waiting time can be to 48 hours. (except holiday seasons which might take longer).

Go to your Themeforest Profile > Downloads Tab > & then You can Rate & Review for our template.

Thank You.

More Templates

Changelog

See what's new added, changed, fixed, improved or updated in the latest versions.

Version 1.0 (3 Jan, 2023)

Initial Release